Is the sun going down on Coal? not according to Peter Bradley (ex Goldman Sachs). Bradley set up Javelin Global Commodities in June last year. He has partnered with Murray Energy, E.ON and a few other ex commodity traders from Goldman Sachs. Together, they hope to take up the slack as major investment is being pulled out.

“The coal generation industry globally is going to be a tough business which creates opportunities because there’s a real desire and need to change – it’s change or die,” said Bradley.

Thermal Coal

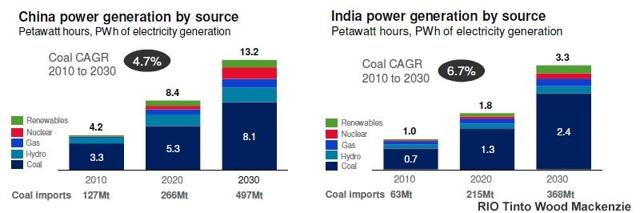

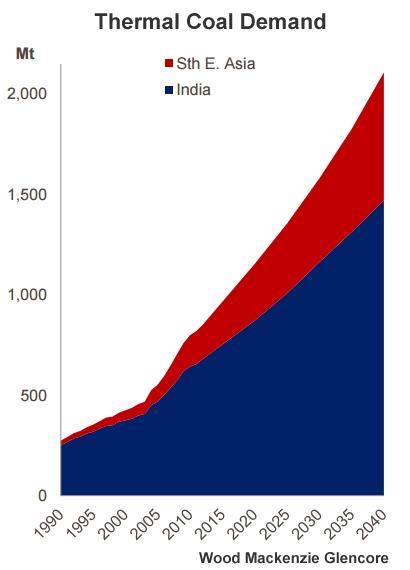

With regard to thermal Coal, you would surmise that the bottom has dropped out of the market. Governments around the world are promising to close Coal fired stations and replace with cleaner alternatives such as Gas, Nuclear and Renewables. The problem with these options is that for emerging economies, clean energy is a luxury they simply cannot afford.

India for one, has ambitious plans to ramp up its coal use, increase production and raise its quota for imports. They have a target of 1.5 billion tonnes by 2020. For years they have struggled to meet their power requirements and black outs were normal. This year appears to be much better for the power supply situation as stockpiles have increased for power stations meaning they have on average 26 days of coal to burn as opposed to 16 days (or less) last year. Imports of thermal coal to India are forecast to grow by 6.2% per year.

As China reduces its coal burn, India is set to become the world’s largest user. The use of Coal by countries around the world is set to change dramatically, with most western Countries sharply reducing their dependence, and most Asian countries increasing. According to the IEA, global coal consumption is set to increase by 0.8% per year until 2020.

Nuclear is not the clear option either as being proved in fuel-starved Japan, where utilities are setting up a new wave of coal-fired stations as a replacement to many of their aging coal units. According to data compiled by Kiko Network, a Kyoto-based environmental group, there are over 40 new coal-fired units slated for construction. Elsewhere, Nuclear faces fervent opposition, as an ongoing survey for the UK’s plans show. Germany’s lignite and anthracite coal power output in 2014 had rebounded to its highest level in more than 20 years, something that researchers blame on cheap CO2 emissions permits and the winding down of nuclear projects. Even though these plants are supposed to be temporary, until replacement energy comes on line, Coal is here for a few more years to come.

Cleaner Burning Coal

In the United States, the Department of Energy is heavily promoting the benefits of integrated gasification combined cycle or IGCC, which has been under development for many years with plants currently in operation being closely monitored. With regard to this, Chinese power generation companies such as Shenhua Group are building super high efficiency power stations that use several new technologies which not only use less coal per kw, but also burn it cleaner. There is more efficiency on the way to, as Shenwu Environmental demonstrate. Even in India, they are proceeding with the integration of more efficient plants.

Metallurgical Coal

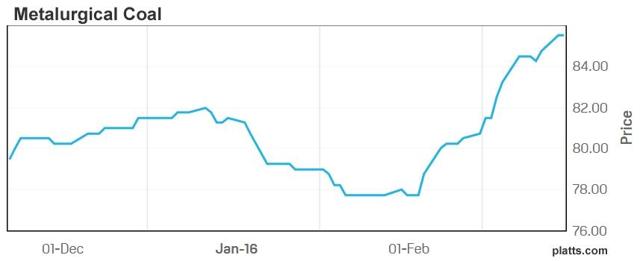

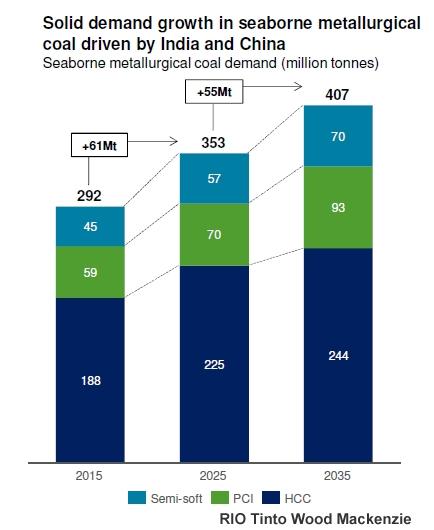

Met Coal has seen an uptick in demand recently. This is no doubt following on from the rise in Iron Ore. There are a number of factors relating to the 8% rise in price since just before the Lunar Holiday. From a reduction in the reserve ratio by PBoC, to the increase in property prices in tier one cities, to the closing of Chinese mines. Supply reduction by BHP who note various reasons for the curtailments, and Teck Resources amongst others have also contributed to a reduction in output of 63 million tonnes.

Overall Coal consumption is still growing, this growth is from Asia, which will dominate the Coal sector by consuming 80% by 2030. India is seen as a favorite candidate for the future of the Met Coal industry. Although they import just 3 million tonnes per year at the moment, this could swell to over 100 million by 2030 which would see them overtake China as the largest importer in the world.

How will Coal Producers fair?

There are many companies in the Coal space. I cannot review them all in this article, so I have selected just a few of the larger corporations. This is to provide a snapshot of commercial prospects, and gives examples of how to profit from the resurgence in the Coal sector. I use EV to Mcap as a broad brush valuation. There is obviously a lot more to valuations than this, but it gives an idea of how the market sees these companies.

Peabody Energy (NYSE:BTU) are the largest purely Coal orientated company. The company is laden down with debt. This debt load from the MacArthur purchase could cause bankruptcy, as a recent announcement stated. However, according to Macroaxis, the possibility is not high. Revenue fell 17% to $5.61 billion compared to 2014. They have managed to reduce cash costs to a small degree in the US. In Australia, cash costs are down to $51 per ton for 2015, but this does include currency factors. This year’s guidance shows a predicted total output of 155m tons in the US with a profit of approximately $4 per ton, and in Australia output of 35m tons and a profit of approximately $10 per ton.

The trading option would be to short Peabody, but there isn’t too much downside left. On the positive side, with an EV of 6.1B and a Mcap of just 47m, we can see they are discounted for bankruptcy. Any good news, will cause a major bounce.

Diversified miners fair better

As the Coal element is the weaker part of a diversified miner’s portfolio, it follows that if there is potential in this area, then the company as a whole would benefit. This assumes the majority of commodity pricing is impacted by the same factors.

BHP Billiton (NYSE:BHP) recognized a 3% reduction in metallurgical Coal and thermal Coal. This was not down to any planned curtailment, it was caused by a machine at the new Broadmeadow mine that failed. This is now operational, which should increase total output for the group. Overall, BHP generated $0.5 billion in free cash flow in 2015 and an EBIT of $348 million just from its Coal operations. This year they expect unit costs to fall even further to $61 per ton.

BHP have growth potential from here. The EV is 97.9B compared to 68.2B Mcap at the moment. All miners are discounted at the moment due to the prevailing sentiment.

RIO Tinto (NYSE:RIO) is in the process of divesting $0.8 billion of Coal assets. RIO’s Coal revenue declined by 23% to $2811 million for the year ended 2015. They managed to increase net earnings from an $83 million loss to a $45 million profit, whilst also increasing EBITDA to $349m.

RIO Tinto are in a similar position to BHP, and perhaps even stronger. The EV is lower than Mcap, 80.7B to 60B.

Glencore (OTCPK:GLNCY) are reducing their prospective Coal output over the coming years in respect of Renewables and Bioenergy. Due to cutbacks and currency favors, Glencore EBITDA for Coal operations dropped slightly from $2416m in 2014 to $2070m in 2015. Met Coal output dropped 24% and Thermal Coal dropped 2% in 2015. Overall revenue from coal reduced by 24% to $7925m.

Glencore suffered from a few bad decisions during the boom, but thanks to their varied portfolio of businesses appear to be getting back on track. The Coal segment is now profitable thanks to major restructuring. There is a good chance of upside potential from here. We may see a pullback in the share price in the immediate future.

Teck (NYSE:TCK) has also reduced cash costs to $74 per tonne down from $99 in 2014. Teck’s Coal output is metallurgical coal and estimate this year will make $23m profit from production. Production fell from 26.69m tonnes in 2014 to 25.27m tonnes in 2015, with a projection to increase slightly this year to 25.5m tonne.

Teck has an EV of 10B and a Mcap of 4.24B. Even though Teck has risen the most out of these five companies. I would see these as having the best potential for share growth.

As the market vectors coal ETF (NYSEARCA:KOL) has recently bounced off its multi year low, there could be a long trade to be had. This is very much dependent on all the above mentioned factors staying true to their course, and of course the US dollar staying away from its high.

Conclusion

Overall, the larger miners are well positioned for the future of the Coal industry. The future doesn’t look good for companies that invested heavily during the mining boom and are now struggling to pay this down. Smaller operations will also struggle, and I suspect we will continue to see more closures. The industry is in transition and growth in Asia will be at the expense of capacity in the West. This will take many years though. Coal is definitely here for the foreseeable future, no matter how much the green lobbyists protest. The fact is, it’s easy and cheap, and we already have stations geared up to use it. I should imagine that with the curtailment of supply, the price of coal will level out. I doubt whether the price will rise too much from here as the rising cost of thermal Coal will prove prohibitive for power stations. Thermal Coal would gain a tremendous boost if the price of natural gas rose significantly. With regard to Met coal, we could see an incremental rise with more steel demand.